Table of Content

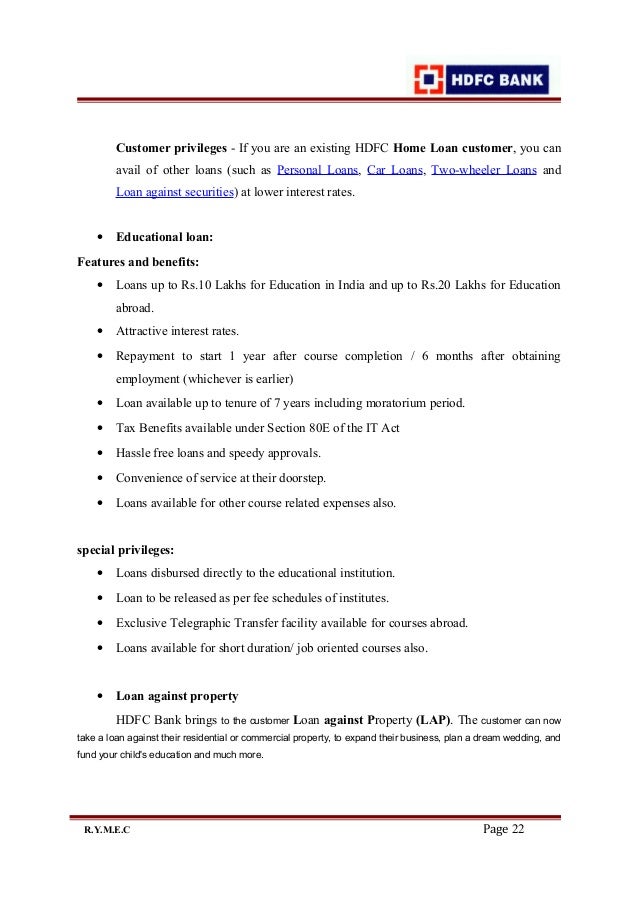

You can now apply for a home loan online in 4 simple steps with HDFC’s quick and easy apply online module. Yes, you can avail up to 90% of the property’s value as a home loan in HDFC Bank. Home Extension loan can be taken if the borrower wants to extend the space in his home by constructing new rooms or floors. Home Improvement loans can be taken for home renovation purposes.

Our chat service on our website and WhatsApp are available 24X7 to assist you with your housing loan related queries. A government employee can apply for a home loan of either 34 times his basic pay or INR 25 lakh, whichever is less. Top-up loan is an amount you get over the running outstanding loan or the loan refinanced from other institutions. Yes, HDFC provides borrowers a top-up of their existing Home Loan up to a maximum limit of Rs. 35 lakhs.

Tranche Based EMI

The maximum period of repayment of a loan shall be up to 30 years for the Telescopic Repayment Option under the Adjustable Rate Home Loan. For all other Home Loan products, the maximum repayment period shall be up to 20 years. Check your loan eligibility before starting your home loan application.

The PMAY scheme caters to Economical Weaker Section /Lower Income Group and Middle Income Groups of the society, given the projected growth of urbanization & the consequent housing demands in India. It is a loan to extend or add space to your home such as additional rooms and floors etc. Delayed payment of interest or EMI shall render the customer liable to pay additional interest up to 24% per annum. Obtain your credit report periodically, say once or twice in a year, verify the same for errors and get them rectified as and when required. The HDFC Home Loan interest rates above are linked to RPLR or HDFC’s BenchMark Rates. 75.1 lakhs and above7.35%-7.85%Home Loan Floating Interest Rate Card for Women – Standard Rates p.a.

When can I make a home loan application?

Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. A Top Up Loan is an additional loan provided by a housing finance company on an existing home loan, with minimal new documentation. The increased rates will be applicable only to existing customers and new borrowers won’t be affected by the rate increase, the HDFC statement added. In case of a partly disbursed loan, the fee payable shall be on the principal outstanding plus the undisbursed loan amount. Housing Development Finance Corporation on Sunday raised its home loan interest rate for existing borrowers by five basis points, following State Bank of India and other lenders.

Kotak Bank also recently cut 10 basis points in its home loan rates for a limited period, claiming its offering to be the lowest in the market. Customers will be able to avail of home loans for 6.65% till 31 March as part of a special offer after the rate reduction, the bank said in a statement. The 6.65% rate is applicable to both home loans and balance transfer loans across amounts. The applicant’s credit score plays a significant role in the home loan interest rate that he can get with the bank. People with low credit scores or disputable credit history may not get low interest rates due to the high-risk factor of repayment involved.

What is part/subsequent disbursement of a home loan?

For home loan approval, you need to submit the following documents for all applicants / co-applicants along with the completed and signed home loan application form. For your convenience, HDFC offers various modes for repayment of your house loan. You may issue standing instructions to your banker to pay the installments through ECS , opt for direct deduction of monthly installments by your employer or issue post-dated cheques from your salary account. Plot purchase loans are availed for purchase of a plot through direct allotment or a second sale transaction as well as to transfer your existing plot purchase loan availed from another bank /financial Institution. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal.

These loans are available for all categories of borrowers at affordable interest rates. Easy repayment options and quick processing further make these home loans more desirable. You may spread out your payments for the loan over a maximum term of 15 years. Meanwhile, lenders including the State Bank of India , Kotak Mahindra Bank also recently reduced the interest rates on home loans.

HDFC Reach Home Loan Interest Rates under various categories: Trufixed Loans -3 years

While the mortgage lender’s existing customers will have to shell out more as and when their loans come up for reset, rates on new loans will remain unchanged as new customers will get a 5-bps discount on the RPLR. "HDFC increases its retail prime lending rate on housing loans, on which its adjustable rate home loans are benchmarked, by five basis points, with effect from May 1, 2022," the company said in a statement. In case of a partly disbursed loan, the fee payable to avail the conversion shall be 0.25% plus applicable taxes of the principal outstanding plus the undisbursed loan amount.

Non-food credit growth has slipped to a multi-decade low of near 5 percent on a year on year basis, according to data from the Reserve Bank of India. Elon Musk’s Twitter reinstated several journalists’ accounts that were suspended for a day over a controversy on publishing public data about the billionaire’s plane. Unlock 30+ premium stories daily hand-picked by our editors, across devices on browser and app.

In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed. The EMIs will proportionately increase with every partial disbursement made as per the progress of construction. Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed.

Home loan is a form of secured loan that is availed by a customer to purchase a house. A housing loan is repaid through equated monthly installments which consists of a portion of the principal borrowed and the interest accrued on the same. HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure. HDFC’s end-to-end digital home loan application process, integrated branch network across the county and 24X7 online assistance can make your home owning journey a memorable one. The country’s largest mortgage lender has reduced its retail prime lending rate by 15 basis points, it said in a release on Thursday.

Factors such as your overall profile, your age at the time of loan maturity, the property’s age at the time of loan maturity, along with the repayment scheme that you have opted for. All of these factors might influence your HDFC home loan interest rate. HDFC Home Loan interest rates are one of the best in the market.

No comments:

Post a Comment